Bitcoin: A Reserve Better Than Gold

History of Fiat Currency

“Money has been essential part of human history for the last 3,000 years. In isolation it has no worth; whether it's a minted metal coin or a piece of paper with a historic icon on it, the true value of money comes from its use as medium of exchange and measurement of wealth.”---visualcapitalist.comMoney in the beginning form of shells has been changed to silver and gold to modern paper form, reflecting the need and development of each financial stage. Paper money was initially backed by gold as people were not confident in face value carried by a piece of paper; thebalance has put up a comprehensive timeline on development of gold standard.

However, the gold standard ended on August 15, 1971. That's when Nixon changed the dollar/gold relationship to $38 per ounce. He no longer allowed the Fed to redeem dollars with gold. That made the gold standard meaningless. The U.S. government repriced gold to $42 per ounce in 1973 and then decoupled the value of the dollar from gold altogether in 1976.

The decoupling makes sovereign fiat currencies' value solely backed by the government. Wikipedia put it more precisely: “Fiat money is a currency without intrinsic value that has been established as money, often by government regulation. Fiat money does not have use value, and has value only because a government maintains its value, or because parties engaging in exchange agree on its value.”

Subsequent chain of events led Central Banks to indulge in money printing acticities whenever economies show signs of recession. Venezuela, zimbabwe, nations money printing out of control, hyperinflation, and this the main reason for fiats death in recent history.

The situation can be resolved or at least minimized if Central Banks back fiats with an ultimate asset. This is impossible until 2009 when Satoshi Nakamoto created Bitcoin, a cryptographic, decentralized, trustless, sound digital money.

How Bitcoin Fits In

Some bitcoiners argue for a replacement of central banks with a new system based on Bitcoin (most recognized symbol is BTC, though some exchanges use XBT) itself, which I think may not be necessary. Before we go into how Bitcoin can complement Central Banks and fiat currencies, first let's have a look at Bitcoin's value.There are numerous sources that you can read for better understanding of what Bitcoin is, but I highly recommend a resource compiled by lopp.net. Besides, influencers from various industries have shown their positive view about BTC as well:

“We are talking about currency here, and there isn't much stuff in this world that money doesn't intersect in one way or another. Even the very nature of governance is changing with the advent of Bitcoin. Real estate, retirement, insurance, health care, company funding, employment, banking, diplomacy, war, you name it – it’s all being re-evaluated. Nothing will remain the same. We're truly experiencing something that has never existed in the world before, something that effects every human on the planet.” said Brenna Sparks, a prominent influencer in the space.

Recently at DTCC Fintech Symposium, when pressed by panel moderator and DTCC managing director Jennifer Peve on what actual problems bitcoin solves, Bob McElrath blockchain architect for Fidelity Digital Assets, gestured to the audience, saying that it was a lack of trust in many of the institutions in the room that was the first problem bitcoin solved, by letting people move value without them. The second benefit of bitcoin was as a counter to risk taken on from other more traditional investments. “The purpose of bitcoin is a hedge against very large scale failure,” he said.

Bitcoin Value Proposition

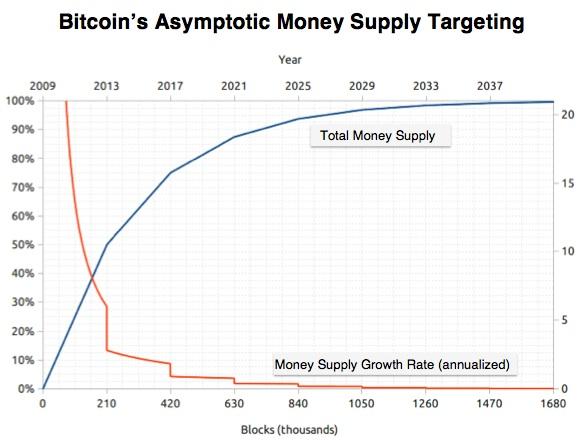

-its sound monetary policy and scarcity: Bitcoin production rate halved every 4 years, refer to Chart 1 for details. With its fixed supply capped at 21,000,000, Bitcoin avoids infinite money supply and hence hyperinflation. One of the biggest flaw of existing fiat monetary policies is to print money endlessly, willingly or unwillingly. When debt piles up, the easiest way out is to print much more money to dilute its effect, that's what most of the countries are doing now. The leads to serious consequences, including hyperinflation.

Chart 1: Bitcoin Money Supply and Production Rate, source: themisescircle.org

-Bitcoin uses SHA-256 for Proof-of-Work mining algorithm and address generation; this makes it the most secured cryptogrphic digital asset in the world; the whole network is run on 10,000 nodes, making it the most secured and yet trustless open ledger, which means BTC doesn't need any auditor or double entry accounting practice to safeguard its credibility. Its decentralized nature also makes it censorship resistant, and highly immune to 51% reorg (double spend) attacks. The nodes now are even put on satelites broadcasting, thanks to Blockstream, which enables Bitcoin's continuous operation in an unlikely event of major natural disaster or nuclear war.

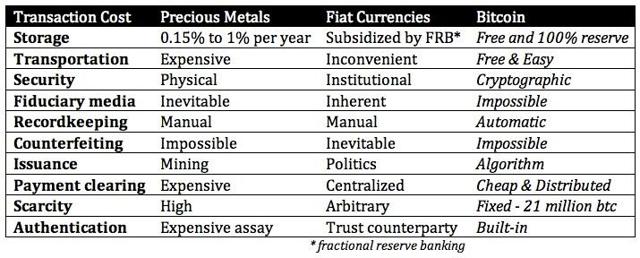

-Bitcoin is highly flexible and easy in trasferring and storing value; with internet and a electronic device, anyone can easily do the transfer and storing it in wallet. Besides, Bitcoin way of transferring value is far more superior than conventional ways, Table 1 summarize Bitcoin's superiority compared to the other two most popular stores of value.

Table 1: Trx Cost for Three Major Store of Value, source: themisescircle.org

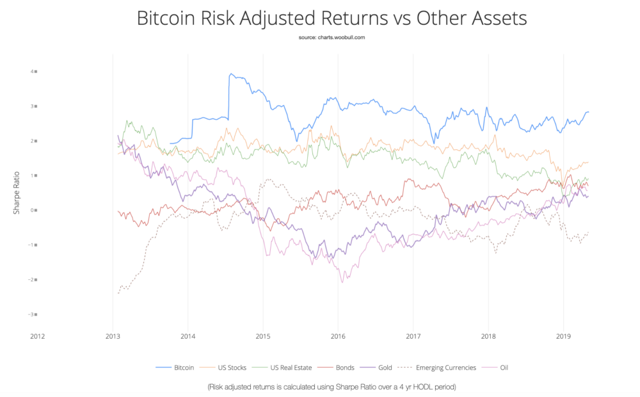

Table 1: Trx Cost for Three Major Store of Value, source: themisescircle.org-Bitcoin is the most uncorrelated asset with conventional asset classes as shown in the Table 2. On top of that, its Sharpe Ratio is also far more outstanding compared to conventional asset classes (Chart 2). This adds tremendous value to investment portfolios performance as proven by numerous studies on small BTC allocation in any portfolio. According to Bitwise, a traditional portfolio (60% stocks, 40% bonds, rebalanced quarterly) returned 26.5% from the start of 2014 to the end of March 2019 with volatility of 6.5%. If the portfolio put just 5% of its money in Bitcoin (57% stocks, 38% bonds, 5% BTC), it would have made 58.5% over the same period with just 2.5% more volatility. In other words, Bitcoin Sharpe Ratio was far higher than conventional asset classes as shown in Chart 2.

Table 2: 9-Year Major Assets Correlation, source: portfoliovisualizer.com

Chart 2: Bitcoin Sharpe Ratio vs Major Asset Classes, source: hackernoon.com

Chart 2: Bitcoin Sharpe Ratio vs Major Asset Classes, source: hackernoon.com-Brand value; according to ccn.com, Bitcoin’s Popularity Beats Trump, Tesla, & Kim Kardashian on Google. Similar to top brands in the world, Bitcoin is a name recognized by many; and this is definitely valuable.

Suffice to say, Bitcoin is revolutionary for existing financial, monetary, book keeping and audit system. These unique but critical properties in turn draws more holders and hence, nodes, which further reinforces its value.

Should Central Banks Consider Buying Bitcoin?

It may not happen in near future, but there's above zero chance that sometime in future, nations will collaborate to buy Bitcoin together for greater good of all.Benefits of doing this:

a) BTC supply is fixed at 21 million, making it more superior than gold as reserve/backing for BM as it's much easier to be pumped to QP = BM equillbrium, where Q = qty of BTC bought, P = BTC price at equillibrium, BM = World Broad Money supply. We will come to this later in calculation part.

b) fiats are fully backed at anytime; and the job of doing this is pretty easy compared to buying and holding gold. We will talk about this later.

c) in the likely event of individual nation's broad money (bm) expansion, it can just buy a bit more BTC to its reserve until qp = bm is reached, here q = BTC held by the nation, p = target equilibrium price, bm = nation broad money supply.

d) in the unlikely event of bm contraction, the nation can sell some BTC to reach qp= bm.

Why Bitcoin and not a controlled cryptocurrency created by nations?

a) BTC is the only decentralized and trustless network with the most massive multinational user and holder base, i.e. it can't be tampered with and no conflict of interest with any nation or party. Failed national cryptocurrencies such as Petro were largely due to its centralized nature, lack of transparency and credibility. You can't create a fail-safe asset within the system. Bitcoin is outside of the system and is therefore immune to any malicious data manipulation.b) BTC nodes will be so wide-spread to every corner around the globe that its network is resistant to natural or man-made disaster; unless there is an extinction level event, Bitcoin can't be shut down or terminated. This makes it safe to keep and to be transferred around even under most critical conditions. The same can't be said for centralized cryptocurrency as the node count won't be that massive. This also means that nations can't buy off every single BTC as empty of nodes will render it worthless.

c) various benefits that BTC can bring to nations, e.g. adoption of clean & efficient energy, minimal waste and sustainable economic growth. Contrary to common belief, Bitcoin mining utilizes mostly green energy; when its price grows, so will mining activities that seek the most economical and efficient ways of producing Bitcoin. Besides, its mining doesn't produce unwanted side products and waste.

Simulation of Central Banks buying Bitcoin and Gold

Next we will do some calculations on Central Banks purchase of each asset and compare the differences.Bitcoin (BTC)

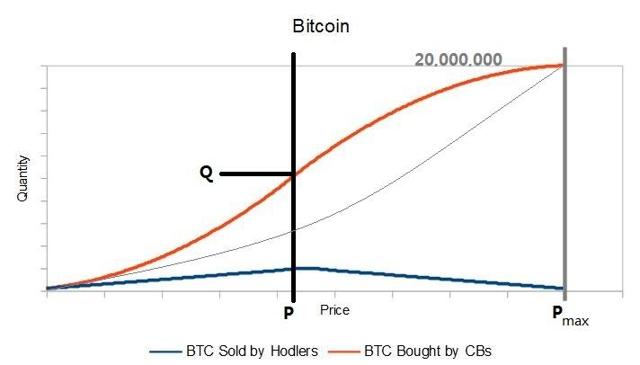

Basicaly Central Banks should buy BTC until the value bought equals to World Broad Money, i.e. QP = BM.

From bitcoinity.com, it was observed that 10,000 BTC market order is needed for the price to pump 10%. This has been proven by a 20% pump in Apr 3rd, 2019 by a mysterious whale with $80 mil market order (= 20,000 BTC x $4,000), source: Bitcoin jumps 20 percent, mystery order seen as catalyst)

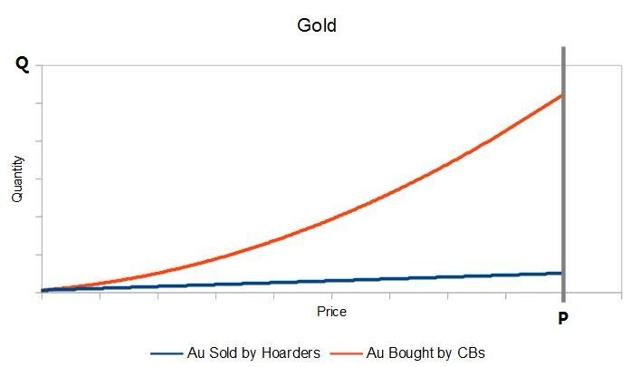

Another factor we need to consider: when price reaches certain height, more people are willing to sell, hence we include a fixed x% increase in our calculation. As BTC supply is fixed at 21 million, the BTC sold should follow a logistic function shown as the red line in Chart 3, i.e. first part happens when coin quantity bought is at exponential phase before selling reaches its peak (prior to QP), but price rally will accelerate at second part during which market sell orders are depleted (every 10,000 BTC purchase will push the price more than 10% during this phase).

Chart 3: BTC Quantity Sold vs Price, source: author

Chart 3: BTC Quantity Sold vs Price, source: authorBTC bought at exponential area can be represented by this equation:

B∑n(1+x)i [P0(1.1)n] = SBM

where

B = 10,000 (the market buy quantity to push the price 10% up)

n = total buy count;

i = buy count;

x = after each 10% price rally, x% more BTC will be sold;

P0 = initial price;

SBM = Broad Money Supply.

Using simple spreadsheet, we can get the data within a few iterations. However, when x was set at maximum, the chart was adjusted to a thin gray line in Chart 3. Let me explain the logic of doing this: As we must have some BTC available for running nodes and other usage, 1 million is the minimum BTC I think we should allow in circulation for non-central banks-custodial use cases; though the data for calculating second part are not available, it's safe to assume net effect of a logistic function is similar to an exponential function, provided we know the maximum coin quantity, which is 20 million. 0% and half of x maximum % were shown for comparison.

Assume P0 = $10,000; SBM = $100 trillion ($100,000,000,000,000)

| x% | End Price ($) | BTC Bought | Free Float BTC1 | Investment2 / SBM | Total Time3(minutes) |

| 0 | 94,200,000 | 970,000 | 20,030,000 | 9.41% | 980 |

| 4 | 18,600,000 | 5,300,000 | 15,700,000 | 1.86% | 810 |

| 8 | 4,900,000 | 20,000,000 | 1,000,000 | 0.49% | 670 |

1) Total BTC supply = 21 million; free float = total supply – quantity bought;

2) Investment = Total money used to buy BTC;

3) Total time = time needed to complete BTC purchase = n multiplied by 10 mimutes per buy count (each BTC block production time is 10 minutes)

What if Central Banks buy after price rises 900%?

P0 = $100,000; SBM = $100 trillion ($100,000,000,000,000)

| x% | End Price ($) | BTC Bought | Free Float BTC1 | Investment2 / SBM | Total Time3(minutes) |

| 0 | 127,200,000 | 760,000 | 20,240,000 | 12.71% | 770 |

| 7 | 15,700,000 | 6,000,000 | 15,000,000 | 1.55% | 550 |

| 15 | 4,600,000 | 18,000,000 | 3,000,000 | 0.44% | 420 |

Let's increase the initial price 9x more,

P0 = $1,000,000; SBM = $100 trillion ($100,000,000,000,000)

| x% | End Price ($) | BTC Bought | Free Float BTC1 | Investment2 / SBM | Total Time3(minutes) |

| 0 | 172,000,000 | 540,000 | 20,460,000 | 17.09% | 560 |

| 20 | 13,200,000 | 6,900,000 | 14,100,000 | 1.21% | 290 |

| 40 | 6,200,000 | 15,000,000 | 6,000,000 | 0.51% | 210 |

Obviously CBs need to pay more money for less BTC when they act late. However, this will be offset with more holders willing to sell at higher price, i.e. CBs can buy more BTC with less money. Based on total time, it's obvious purchase can be done within same day.

One may ask, wouldn't it be easier to just buy one lump sum of Bitcoin? This is not feasible due to: 1) every 10,000 purchase needs 10 minutes to propagate the new price to every exchange around the world; 2) buying with 10,000 BTC per order will take advantage of compounding effect, and much easier to fine tune the amount of BTC that needs to be bought.

Gold (Au)

According to coinmetric.io, BTC volatilty is around 10 times gold; from here we can deduce that for 8% daily BTC volume to pump the price by 10%, 79 metric ton (MT) is needed to pump 1% of gold price (daily gold spot volume is about 988 MT).

Now let's look at gold (AU):

Assume P0 = $40,000,000/MT; SBM = $100 trillion ($100,000,000,000,000)

| x% | End Price / MT ($) | Au Bought (MT) | Free Float Au1 | Investment2 / SBM |

| 0 | 2,900,000,000 | 35,000 | 165,000 | 23.00% |

| 0.7 | 1,100,000,000 | 98,000 | 102,000 | 7.80% |

| 1.4 | 520,000,000 | 193,000 | 7,000 | 3.77% |

Note:

1) Total Au supply above ground = 200,000 MT; free float = total supply – quantity bought;

2) Investment = Total money used to buy Au.

As gold supply is near unlimited, higher price encourages more mining at more remote or challenging places, which will dampen the price. Apparently, calls by some politicians to back fiat currencies with gold, if carried out, will be futile. Even if Central Banks decide to accumulate gold as stipulated in the table above, the price will still drop within a few years, as more advanced mining technology is developed. Chart 4 shows this situation.

According to westcoastplacer.com,

All gold ever mined = 200,000 MT

All gold in continental crust = 35,000,000,000 MT

All gold in seafloor crust = 87,000,000,000 MT

All gold in the Earth core = 39,400,000,000,000,000 MT

And we even have gold in asteroids according to some scientific reports. So basically the gold supply is unlimited.

Chart 4: Gold Quantity Sold vs Price, source: author

Chart 4: Gold Quantity Sold vs Price, source: author

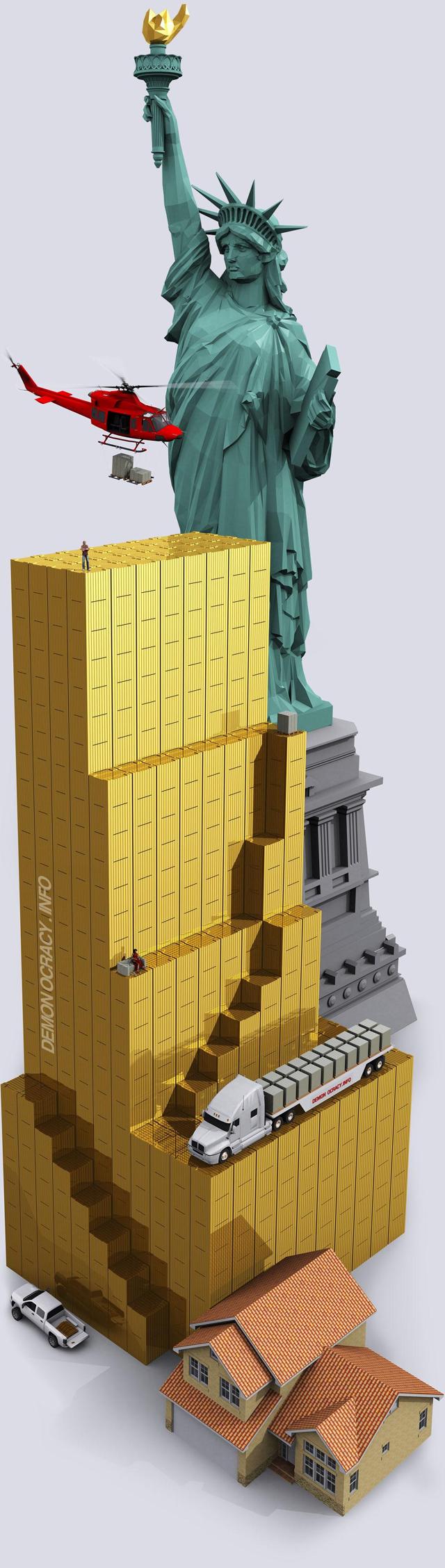

As gold is much bulkier compared to Bitcoin (picture above shows how bulky 200,000 MT of gold bar is, source: demonocracy.info), it needs months or even years to transport all the gold purchased back to respective nation. For example, German gold repatriation begun in 2013, and it still continues. The majority of Germany's gold is held abroad. The Bundesbank plan is to repatriate gold in sufficient amount to have at least half of their gold in Germany by 2020. Besides, insurance inccurred and logistics involved will be a lot, please refer to Table 1 for details.

Gold isn't censorsip resistant, recently BOE just refused to repatriat gold of Venezuela for fear of money laundering. Exactly 86 years ago, FDR took the United States off the Gold Standard. It was illegal for Americans to own bars of gold. Unlike Bitcoin, gold can be censored or confiscated easily by the state.

Last but not least, gold is not pupolar among younger generation. According to Nate Geraci, president of the ETF Store, an independent investment advisor, 90% of millennial investors overwhelmingly desire to hold bitcoin instead of traditional hedge assets like gold. Sooner or later, gold will lose its shine to Bitcoin.

Nice work,

ReplyDelete5 legit Bitcoin earning mining sites

Earn bitcoins

This comment has been removed by the author.

ReplyDelete